DE LA RUE

2017/18 FULL YEAR RESULTS

De La Rue plc (LSE: DLAR) (De La Rue, the “Group” or the “Company”) announces its full year results for 12 months ended 31 March 2018 (the period or full year). The comparative period was 12 months ended 25 March 2017.

FINANCIAL HIGHLIGHTS

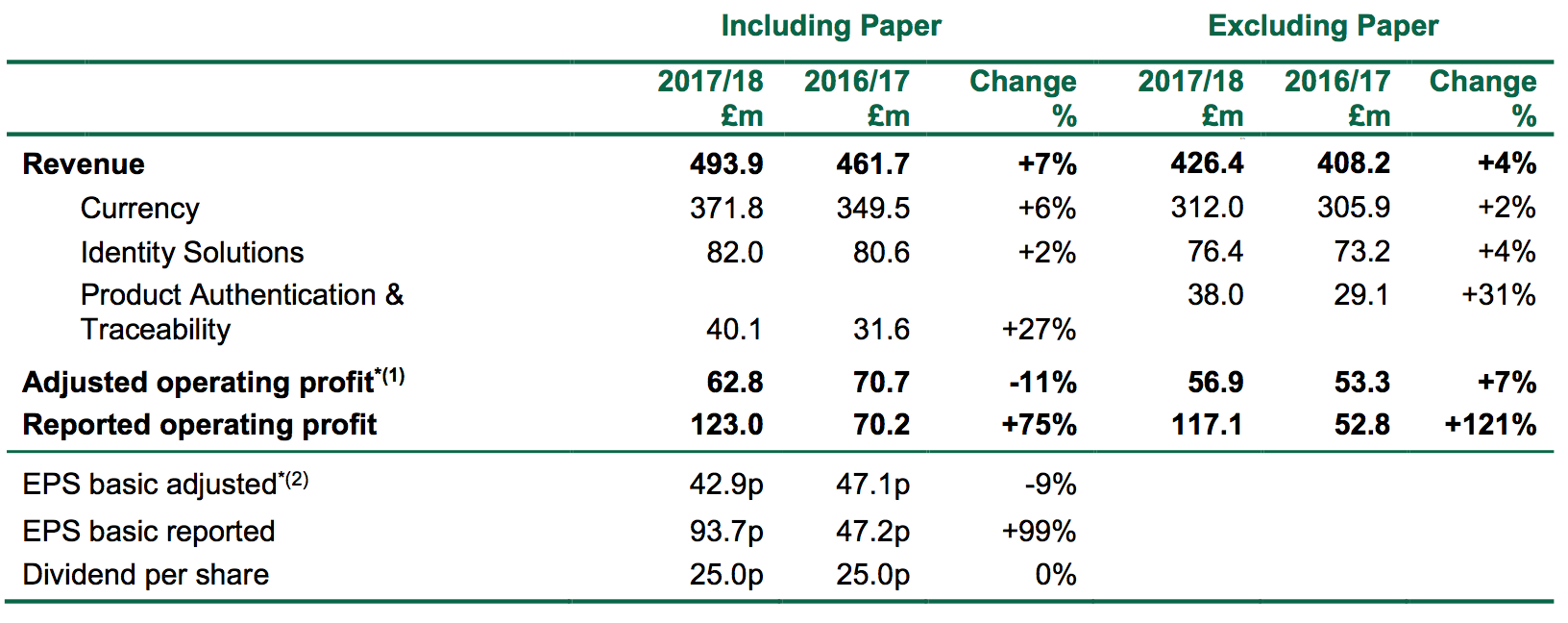

- Group revenue +7% at £493.9m; adjusted operating profit*(1) -11% at £62.8m.

- Excluding the exited paper business, revenue +4% and adjusted operating profit*(1) +7%

- Adjusted EPS -9% to 42.9p; reported EPS +99% to 93.7p

- Net debt of £49.9m (25 March 2017: £120.9m), £71.0m lower than the prior year and the lowest in five years, reflecting the £60.3m cash proceeds from the paper transaction as well as better working capital management

- IAS 19 UK pension deficit on a pre-tax basis reduced to £87.6m (25 March 2017: £237.0m)

- Proposed final dividend of 16.7p; full year dividend unchanged at 25.0p

- Group 12 month order book at March 2018 excluding paper orders +6% to £363m (2016/17: £341m)

STRATEGIC AND OPERATIONAL HIGHLIGHTS

- Another year of significant progress against our strategy to become a less capital intensive, more technology led business

- Completed sale of the paper business with a ten year guaranteed supply agreement which reduces the Group’s exposure to the volatility of the paper market

- Polymer momentum has gathered pace

- Volumes more than doubled to 810 tonnes

- 24 issuing authorities across 50 denominations, representing more than half of the world’s total polymer note issuers

- DLR Analytics™ launched in May 2017 now has 70 or nearly half of the world’s central banks signed up, 1/3 of which are new to De La Rue

- Accelerating growth through further investment

- R&D investment increased by 13% year on year – 33 patents filed and 46 patents granted

- Enhanced our product offerings with two strategic partnerships – with Opalux for security features and with Optel for track and trace technology

- Investment in sales and marketing drove growth momentum – international ID and PA&T order intake +117% and 97%, respectively

- De La Rue Authentication Solutions acquired in Jan 2017 ahead of plan

- Programme to become world class manufacturer continues

KEY FINANCIALS

This is a non-IFRS measure. Amortisation of acquired intangible assets is a non-cash item while exceptional items are non-recurring in nature. By excluding these items from the adjusted operating profit and EPS metrics, the Directors are of the opinion that these measures give a better understanding of the underlying performance of the business. “Reported” measures are on an IFRS basis. See note 13 for further explanations and reconciliation to the comparable IFRS measures

(1) Excludes exceptional item net gains of £60.9m (2016/17: net charges of £0.4m) and amortisation of acquired intangible assets of £0.7m (2016/17: £0.1m)

(2) Excludes exceptional item net gains of £60.9m (2016/17: net charges of £0.4m), amortisation of acquired intangible assets of £0.7m (2016/17: £0.1m) and related tax charges of £9.7m (2016/17: credit of £0.6m)

Revenue and adjusted operating profit growth rates for the Identity Solutions and Product Authentication & Traceability reflect a change in allocation of results for these segments made in the year.

Martin Sutherland, Chief Executive Officer of De La Rue, commented:

“Over the course of this year, De La Rue has achieved some significant milestones in delivering against our five year strategic plan to transform the Group into a less capital intensive, more technology led business. The Invest & Build product lines, namely Polymer, Security Features, Identity Solutions and Product Authentication & Traceability, now contribute more than a third of the Group’s revenue and over half of its operating profit.

“Solid growth in all segments has been offset by strategically focused increases in investment in R&D and sales, which will drive long term sustainable growth. While losing the new UK passport tender was disappointing, it does not change our goals, nor does it detract from the underlying performance of the Group which remains strong.

“The sale of the paper business and the associated long term paper supply agreement have reduced our exposure to the volatility of the oversupplied paper market, while securing the surety of supply for our print business. Through this, and good cash generation from the business, we have significantly strengthened our balance sheet with net debt now at its lowest in five years. The stronger balance sheet provides the Group with greater flexibility to allocate capital to deliver long term shareholder value.”

View the full announcement as a PDF

Enquiries:

De La Rue plc

+44 (0)1256 605000

Martin Sutherland

Chief Executive Officer

Helen Willis

Interim Chief Financial Officer

Lili Huang

Head of Investor Relations

Brunswick

+44 (0)207 404 5959

Katharine Spence

Stuart Donnelly

A presentation to analysts will take place at 9:00 am BST on 30 May 2018 at The Lincoln Centre, 18 Lincoln’s Inn Fields, WC2A 3ED. The presentation will also be accessible via a conference call and a video webcast. Dial-ins for the conference call are below.

Live conference call

UK Primary: 0844 800 3850 Passcode: 581 268 International: +44 844 800 3850 UK Direct: +44 (0)20 8996 3900 Archive conference call UK free phone: 0800 032 9687 Passcode: 2427 1325

Available from 31 May until 14 June 2018 For the live webcast, please register at www.delarue.com where a replay will also be available subsequently.