Gain a deeper understanding of your cash cycle

DLR Analytics™ is a cloud-based software service that uses carefully selected mathematical models to give you data-driven insights, including:

- Standardised reporting

- Charts and graphs for key metrics

- A forecasting toolkit

- Descriptive statistics tables

- Analytics and trends from derived data

- Help guides and support

See the future of your cash cycle

With banknote forecasts and quantifiable insights on banknote lifetimes and circulation velocity.

Compare your data

View aggregated, anonymised data from other users, compare your data with other central banks in your region or in similar situations to help you make informed decision.

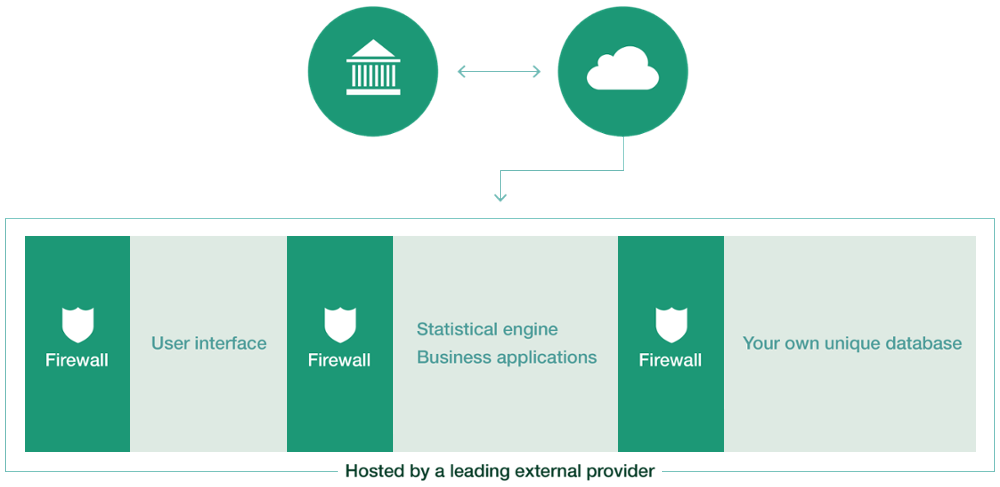

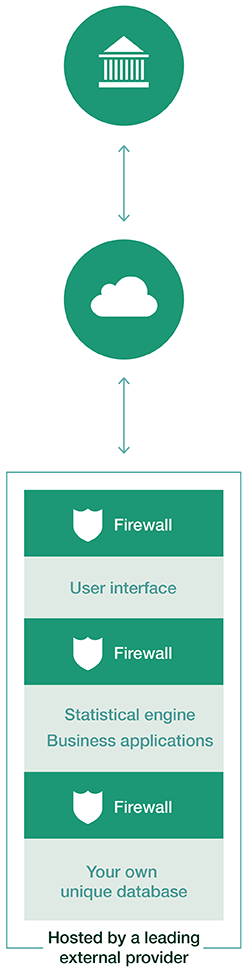

Your data within DLR Analytics™ is completely secure

We employ professional hackers for regular penetration testing of DLR Analytics™ and follow their recommendations to ensure that your data remains secure and we remain on top of the latest security threats.

Make the most of your cash cycle data

Statistical approach

We take a statistical approach to data and we give you a calculated level of certainty as part of your results. The quality of data you input will affect the quality of analytics.

Pooled data

DLR Analytics™ also offers valuable pooled data which we collate, anonymise and share to offer you global and regional trends and insights.

Speed and simplicity

Graphs and charts update automatically when new monthly data is added, ready for you to review or export into presentations and reports.

Got questions? We've got answers

Is DLR Analytics™ right for me?

DLR Analytics™ is available to every central bank and using authority in the world. There’s no need to invest in serial number tracking or advanced sorting machines: DLR Analytics™ can help answer many of the same questions as these larger data solutions.

DLR Analytics™ uses a standardised set of statistical tools and a standardised language, all banks can view and compare aggregated, anonymised data on banknote and cash cycle performance from around the world.

Where does DLR Analytics™ data come from?

We use aggregated central bank data (such as circulation volumes) and publicly available data (such as IMF projections of GDP growth).

Who owns the data?

It’s your data and you retain full ownership of it while using the DLR Analytics™ service.

So we can help you get the most insight from your data, you agree to give us access rights to your data. We keep your data and conclusions from any analysis completely confidential and we don’t share them with third party without your express permission.

The first time you log on you’ll be shown our T&Cs which describe in detail how we protect your data.

Who's using DLR Analytics™?

More than 70 central banks, including some of the smallest and largest countries in the world.

How secure is my data?

We take data security very seriously. All sensitive data is encrypted, all communications are encrypted and your data is stored in a database that is unique to your central bank.

The DLR Analytics™ application and our hosting provider have both passed third party penetration testing, which is routinely repeated and our Information Security team rigorously assess our hosting provider’s procedures and operations. Your data and the application are backed up*, and access to the DLR Analytics™ application requires authentication, with all communications over SSL.

*We recommend that you also maintain your own copy of your data.

Request a demo at your offices or online

Browse the Insight Papers and Resources Library

What’s happening to the volume and value of CIC?

Analytical insights into the cash supply chain.

An external perspective on digital currencies

What are digital currencies, crypto currencies and virtual currencies?

Introducing Forecasting and D-Metric

Learn how in-depth forecasting can help ensure you have the right levels and denominations of notes in stock.